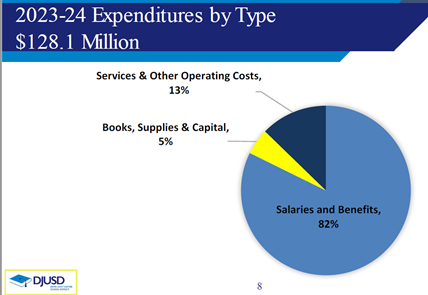

Why you should consider voting NO on Measure N :Measure N is NOT a renewal. Renewal means to continue the same with the same conditions. Measure H that was voted on was $620 and was for eight years only. Measure N however is a new permanent parcel tax. The amount is different and has no sunset. It creates a PERMANENT obligation imposed only on Davis homeowners. It starts at $768 +++ but with built-in increases every year with no limit. The difference in the amount and the terms makes it clear Measure N is not a renewal but a new tax. This PERMANENT tax will avoid oversight and public scrutiny. You will not have an opportunity to have a say again. If Measure N passes there will not be any renewals or accountability because it is forever. Many Davis residents that voted YES for these TEMPORARY measures are having second thoughts about committing themselves to an infinite increasing PERMANENT tax. If you voted yes in the past, the time has come for you to consider voting NO because if you vote yes, you are acquiring an eternal debt. If you vote YES on Measure N, you are acquiring a variable debt forever with no limit. You will pass that to your children and future generations. It takes precedence before you even consider your own mortgage and household expenses. You will be able to pay your mortgage but not these taxes. MEASURE N IS DIVISIVEMeasure N is divisive to our community. It divides it into three groups. 1) Those who owe a home and pay the taxes, 2. Those who do not live in a home but vote to impose the tax on the first group and 3. Those who are exempt which also can vote to impose the tax on the first group. If you are in the second group and do not have to pay the taxes, please refrain from imposing it on a homeowner or Vote NO on Measure N Exempting School District Employees from paying parcel taxes is offensive to the Davis community. Last year, 176 School District employees were exempt from paying parcel taxes in (2022-2023).How does that help schools or the students? Yet, we are being asked to tax ourselves with a $768 ++ eternal debt?WHAT IS THE IMPACT ON THE STUDENTS?In 2023-2024, the School Board collected 123.1 million dollars but they spent 128.1 million. They overspent 5 million dollars, that is the kind of management we have. How much did the students benefited? Their own report shows that 82% of that money $98.4 million dollars went to employee salaries. 13% to operating costs (16.6 million) and only 5% (6.4 million) to books and supplies for students.

Are the benefits really getting to the students? The answer is obviously NO. The School Board wants you to believe that the parcel taxes are responsible for the good education in Davis. This is completely false. The bulk of the budget to make that possible, $111.4 million is paid by our federal and state income taxes besides our property taxes and not by the parcel taxes.Of the 123.1 million only 11.7 come from the parcel taxes and 111.3 million come from our federal and state income taxes. The parcel taxes are less than 10% compared to the other contributions we are paying to maintain good quality schools. Proponents are deceiving the public.IF YOU RENT A HOME OR APARTMENT YOU NEED TO VOTE NOLandlords no doubt will pass the new permanent parcel tax on to you and you rent will go way up every year because the parcel tax increases every year.The tax does not decrease in years of recession, if property values fall, or if funding from other sources is more than enough to cover district employees salaries. Emotional appeals using selective reasoning and lacking full disclosure appear in our mailboxes. The website’s colorful graphs, pictures and pretzel logic present a one-sided and misleading view of the issue.The DJUSD would have us believe that without Measure N our teachers and educational programs will suffer. That is a scare tactic. We contribute with our income taxes federal and state income taxes and property taxes $111.1 million out of $123 million we contributed for the schools in 2022-2023. |

NEVER GIVE THE POLITICIANS ON THE SCHOOL BOARD INFINITE ACCESS TO YOUR MONEY

MEASURE N DOES THAT BECAUSE IT IS FOREVER